The annual budget is a vital part of every organization’s finances, whichever industry or sector it belongs to. The same applies to a homeowners association. With the coming of each financial year, a proper budget must be drafted out, but not all associations know how to prepare an HOA budget. Thankfully, we have come up with some guidelines that make preparing your HOA budget an easy task.

How to Prepare an HOA Budget the Right Way

An HOA budget is paramount to the financial success of every community association. Despite its significance, there are so many organizations that fail to prepare an HOA budget. The resulting outcome for these HOAs is to face financial troubles in the year ahead — something they could have easily avoided had they been proactive. So if you do not want all your funds used up halfway through the year, plan now.

Here are some HOA budgeting guidelines that can help you with this:

1. Assemble a Task Force

While it is part of an HOA board’s duties to prepare an HOA budget, assembling a task force dedicated to the undertaking will help a lot. The task force need not be comprised of only board members.

While it is part of an HOA board’s duties to prepare an HOA budget, assembling a task force dedicated to the undertaking will help a lot. The task force need not be comprised of only board members.

As a rule of thumb, the team must include the board president, treasurer, and community manager. Additional members must include finance and budget committee heads.

With a team solely devoted to preparing your HOA budget, you will have a higher chance of success.

2. Schedule a Separate Budget Session

You may be tempted to schedule budget planning on the same day as an important meeting or event. However, budget planning is not an afterthought or something that can be reserved for the extra minutes following a community meeting. It deserves — nay, demands — its own session. When you schedule your budget planning session on the same day or right after a different meeting or event, you risk going into it distracted or tired.

Make sure to dedicate an entire day or afternoon for planning your HOA annual budget. This should give you enough time to consider all factors that may affect your finances. It is also important that all participating parties be present during the session. Go into the meeting with a clear head and an open mind. Taking breaks is fine, even necessary, but do not rush planning. Take your job seriously, especially when money is involved.

3. Establish Clear Objectives

Once budget planning is in session, you and your team must begin by outlining the next few years’ worth of community goals. What do you hope to achieve for the community in the next 3 to 5 years?

When establishing these goals, you must take everyone’s opinions into account. Yours is not the only voice that should be heard. Therefore, make it a point to survey all homeowners prior to the planning session. Ask them what changes they want to see and what should remain the same.

Of course, just because a homeowner wants something does not mean the board must give it to them no questions asked. Determining objectives should help you get a picture of what everyone wants the community to be like in the future. It is not a non-negotiable to-do list. Once you have goals in mind, you can plan your budget accordingly for the year ahead.

4. Determine Your Current Financial Situation

The next step in preparing your HOA budget is to evaluate and assess your current financial standing. Go through your records of the last two years and analyze them thoroughly. You can even review the budget for your previous year and compare it with actual costs. Note down areas where you spent more or where you did not spend enough. With a basic understanding of where the money should go, amend these allocations in the new budget.

5. Prioritize Your Repair and Replacement Projects

Repairs and replacements are a significant part of every HOA budget. A well-kept community is not only pleasing to the eyes but also helps increase property values.

Repairs and replacements are a significant part of every HOA budget. A well-kept community is not only pleasing to the eyes but also helps increase property values.

When repairs or replacements are ignored, overall satisfaction within the community drops. Worse yet, property values could take a dip as well. As such, repairs and replacements must be handled properly.

While doing so, keep one thing in mind — you cannot take care of all of them at once. As much as you would like to, these types of projects require individual attention. Make sure to prioritize them on the basis of their urgency and importance. Only then will you be able to manage them effectively.

6. Anticipate Changes Outside Your Control

Let’s face it — no matter how much you plan, there will always be something that might go wrong. That is just the way life goes. However, if you plan ahead and anticipate changes, you are more equipped to handle them when they come along. The same goes for when you prepare an HOA budget.

There will always be outside forces beyond your control. The economy, for one, is quite volatile. Prices rise every year due to inflation and increased wages. This could directly affect how much you pay your vendors. What they charge you for the coming year may not be the same as the year prior.

Furthermore, not all homeowners pay their dues religiously. There will always be residents who are behind on their HOA fees and assessments. Every HOA must keep a record of delinquent accounts as part of their financial reports. Taking a look at delinquent trends can help you predict how many homeowners will default on their payments this year.

Changes inside and outside of your community can affect your HOA’s financial situation. As such, you must take these factors into account when you create your HOA budget.

7. Get Ballpark Figures

It has already been established that there are certain factors outside your control. When preparing your HOA budget, you must do everything you can to get these factors within your control. That means contacting vendors and agencies for ballpark figures.

It has already been established that there are certain factors outside your control. When preparing your HOA budget, you must do everything you can to get these factors within your control. That means contacting vendors and agencies for ballpark figures.

For instance, every year, the utility rates rise. Contact a local agency, and they might be able to provide you with a price rate schedule that has been decided beforehand. All increases in utility rates are made with respect to this. If you cannot find any information, you can expect an increase of around 7% on a yearly basis.

Homeowners associations also have contracts with a number of other vendors. This includes landscaping companies, property management firms, pool contractors, and so on. Discuss your contract with all of them and ask whether they have any plans to increase their fees. Then, adjust your budget accordingly.

8. Focus More on Needs Rather Than Wants

The expenses of an HOA can be divided on the basis of needs and wants. As an example, everyone wants landscaping to be appealing, but everyone needs a secure environment. As you can see, both are important. But, naturally, the needs come first before the wants. When you plan your budget, cater to the needs and make sure there is money for them. After that, you can turn your attention to the wants.

9. Plan Your Reserves

An HOA’s reserve fund is equally significant when you prepare an HOA budget. A portion of dues must be set aside for the reserve fund every year to plan for future repairs and replacements.

An HOA’s reserve fund is equally significant when you prepare an HOA budget. A portion of dues must be set aside for the reserve fund every year to plan for future repairs and replacements.

Stay on top of your reserve fund by updating your reserve study on an annual basis. This should help you with your HOA reserves calculation, which you can then allocate in the coming year’s budget.

Savings should be a part of every budget. Of all the income you earn, try to deposit at least 20% of it in a reserve or savings account.

10. Create Your HOA Budget

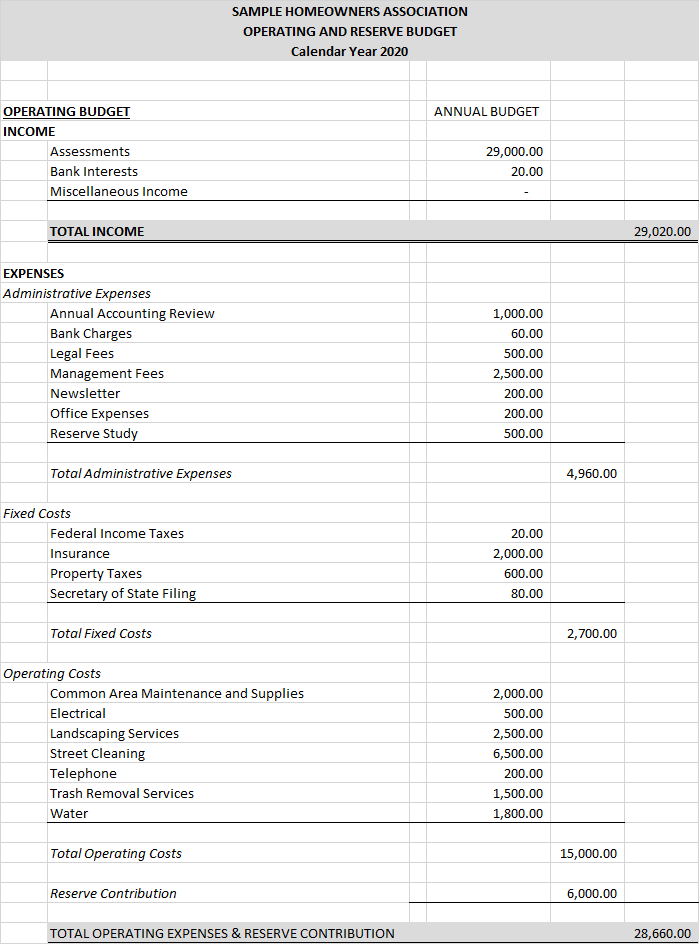

Now that you have analyzed all factors, you are ready to create your HOA budget. List down all anticipated costs, as well as their estimated figures. When in doubt, it is better to overestimate rather than underestimate. Generally, here’s what to include in an HOA budget:

- • Income

- • Administrative costs

- • Utility costs

- • Contract and services costs

- • Insurance costs

- • Portion for reserves

After arriving at a final annual budget, you can then divide it by the number of homeowners to calculate HOA fees. There are HOA budget templates or HOA budget samples you can access online. This is what it looks like:

Click here to download the FREE HOA Budget Template from Cedar Management Group

Financial Success Starts with Responsible Budgeting

No HOA is exempt from budget planning. If you want to properly prepare an HOA budget, you must do it with a team and consider all possible factors. When you fail to come up with a budget, you run the risk of financial ruin. An abysmal budget plan can lead to miscalculated HOA fees, which can then lead to special assessments or depletion of reserves. With no money, maintenance and repairs suffer. Soon enough, you will be looking at low property values and unhappy homeowners.

While budget planning is critical to an HOA’s success, it does not stop there. You will also have to make sure that you stick to the budget throughout the year.

If your HOA is having trouble with budget planning and follow-through, it may be time to turn to an HOA management company. Should that time come, keep us in mind.

RELATED ARTICLES:

- HOA Financial Management: Let Your HOA Management Company Protect Your HOA’s Money

- 7 Things To Remember About How To Run An HOA With Great Success

- HOA Checklist: Settings Your Eyes On Yearly Goals